About What is Phygital Now?

It’s easy to think of physical and digital banking as being in competition. They don’t have to be. They work best in collaboration. Because customers want both.

Sign up Subscribe for updates

Stay on top of all things phygital, by signing up for news, events, and other info.

When physical and digital experiences work together, every customer’s every payment moment shines.

Whitepaper Customers want phygital payment experiences.

Here’s how to deliver them!

News Thought leadership

Stories and studies on the evolving phygital landscape

Resources Information into insight

See how phygital is changing the banking world for card issuers, with these industry surveys and reports.

Products Card Issuance Services

Our ecosystem of products and services that make the most of a phygital world.

The gap between a new card being approved and delivered no longer results in customer frustration.

Instant issuance lets customers print their physical card in-branch, at a kiosk, even start with a virtual card in their phone. Zero delay – and high customer satisfaction.

Card activation, card renewal, card personalisation: there are many touchpoints where customer engagement can be maximised.

Smart issuance puts them to work for you, with front-end apps and back-end infrastructure that connect every milestone on the customer journey and turn it into delight.

The payment card is an important link to your brand. No matter if your customers have opted for a credit card or debit card. Today payment cards offer so much more than just the key to fast and secure payment. Personalization, card material and many other physical and virtual services play an important role for both the cardholder and the card-issuing bank.

Let us manage your card issuance. This puts you as the issuing bank in the enviable position of being able to dedicate yourself completely to your core business and manage relationships with your cardholders.

FAQs Questions answered

The top 10 most frequently asked phygital questions.

A phygital strategy blends the benefits of physical banking infrastructure – branches, real-world branding, payment cards – with the advantages of digital, such as easy-to-use websites and virtual payments. By doing so, today’s bank (traditional or neo) can offer a superlative customer experience at the most effective cost.

Phygital allows a bank to address all parts of the customer experience, without missing out on important brand-building touchpoints like branch visits or carrier opening (for neobanks) or frictionless payments via app (for traditional banks). This closes the gaps inherent to a physical-only or online-only model where customer and business pains tend to reside.

For traditional banks, it’s about making best use of digital tools to extend and deepen customer engagement, in a world where branch networks are in flux. For online-only “neobanks”, it’s about reaching into the real world of physical infrastructure to maintain a tactile presence, such as offering physical payment cards. Each approach lets a bank of either type broaden its customer appeal across its entire audience.

Cost pressures on traditional branch networks and ongoing costs of legacy IT are driving large banks to “go digital”. But there’s an opposing trend for neobanks: the need to have some physical presence for a larger brand footprint, without losing the cost advantages of an online-only model. These business challenges drive this emerging landcape.

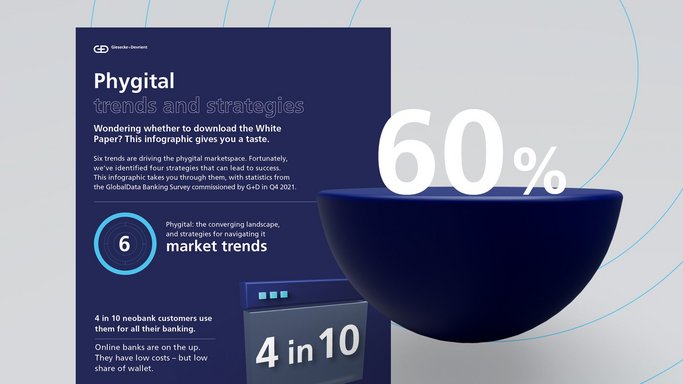

There are four. Greater customer understanding through insightful combining of data points; broader business opportunities of being present on multiple channels; the ability to automate at scale; and the increased number of areas where competitive advantage can be won.

Six factors are evident in the emerging phygital landscape: the rise of neobanking, the emergence of non-banking financial options for customers, the move of digital-only companies into the physical space, the need to merge services across traditional silos, the increasing number of device choices, and the effectiveness of APIs and cloud services.

G+D has created a set of resources spanning informative whitepapers, up-to-date surveys with industry professionals, and an expert-led webinar. See your choices here.

Yes! Download “Opportunities in the Phygital Landscape” from this website here.

Convego® is the collective brand for an end-to-end set of solutions enabling banks to offer both physical banking services such as card issuance worldwide, plus a complementary set of digital services including virtual cards, secure transactions, and innovative payment solutions. Explore Convego® here.

Convego® Instant Issuance brings card issuance closer to the customer, with solutions that let banks offer in-branch, at-kiosk, and at-home card delivery complete with virtual card solutions that remove the gap in customer service caused by delivery. Smart issuance takes personalization and customization several stages further, with applications that let customers create their own card designs and banks answer new use cases in the issuance space.

Established in 1852 with physical locations in 32 countries and ongoing activities from 74 subsidiaries covering the entire world, Giesecke+Devrient’s 11,500 people are responsible for reliable, secure, and safe delivery of payment solutions for hundreds of global banks and other financial institutions worldwide, with a decades-long track record that speaks for itself.

Contact Take the next step into phygital

Ready to talk phygital with G+D? Just complete this form.